Positive Business Climate

A supportive climate for investment

Why is Squamish such a great place for investment? Who are the entrepreneurs that call Squamish home? Read on below to get information about our business climate and why Squamish is an ideal location for entrepreneurs.

New businesses are popping up everyday

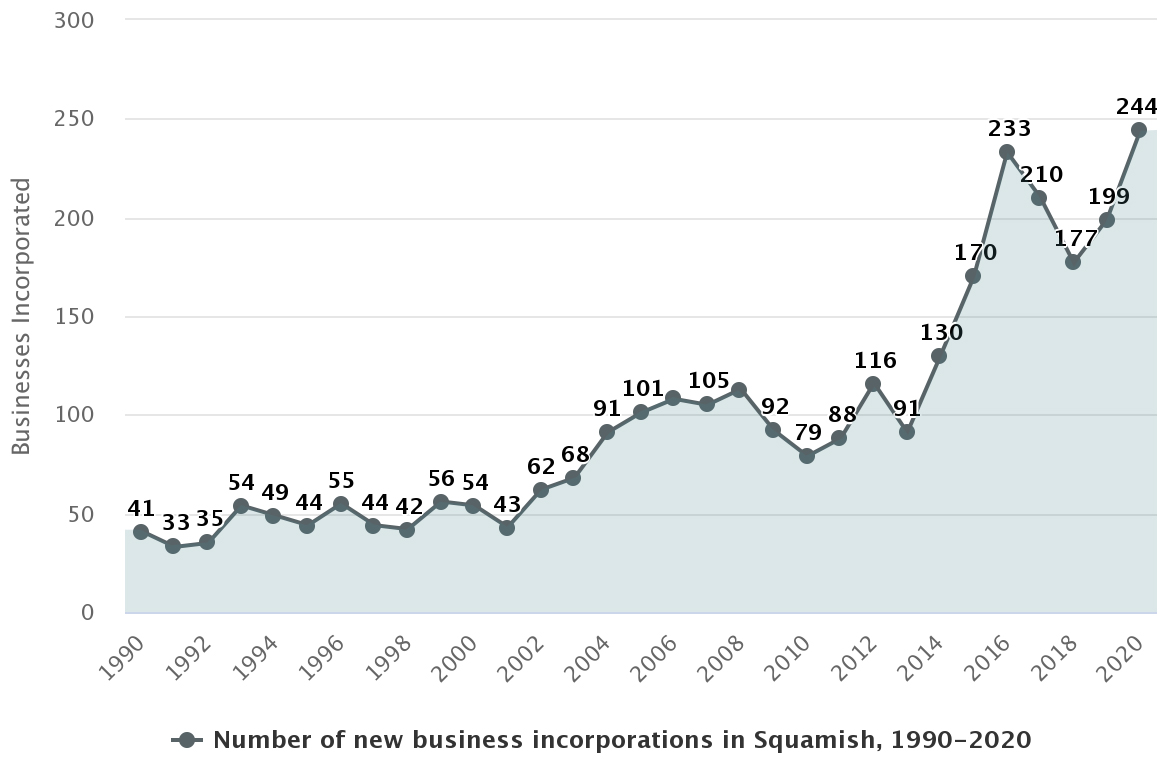

With a total of 2,721 active business licenses in the District of Squamish in 2021 and 244 businesses incorporated, the business atmosphere in Squamish is vibrant to say the least. To put this into context, the number of business licenses has grown 17% since 2020 while the ten-year (2011-2020) annual average growth rate for new business incorporations in Squamish is 14%, ten points above the B.C. average of 4%.

2.7K active business licenses in 2021

17% growth over 2020

Annual business incorporations

Employment space and housing to reflect the growing workforce

The District is committed to ensuring that the amount of employment space available reflects the growing workforce population. We want our workforce to have the opportunity to work locally. This translates into working with the development community to ensure an adequate supply of the right type of space is available to local businesses while also working to ensure diverse and affordable housing options are available.

Building permit values

$600M over 5 years

$113M in 2020

Squamish development incentives

Looking to develop employment space or start a business in the District of Squamish? The District has several incentives related to land and business development. See the list below and click on the links to get more detail:

- The District's Priority Development Application Review Policy prioritizes various forms of development including employment space, energy efficient buildings, market rental housing, and affordable housing.

- Zero Carbon Step Code - Introduced in a May 1, 2023, this program is an update of the BC Building Code. It provides several options to reduce the amount of operational carbon emissions from a building by requiring lower emissions from space and water heating systems.

- Permissive Tax Exemption Policy - The District of Squamish may on a request-by-request basis, support voluntary non-profit organizations by exempting land or improvements, or both, from taxation under Section 224 of the Community Charter. Council will consider application for Permissive Tax Exemption annually.

- For information about funding and incentives for efficiency improvements, please visit the Natural Resources Canada Grants and Financial Incentives website.

Competitive tax and utility rates

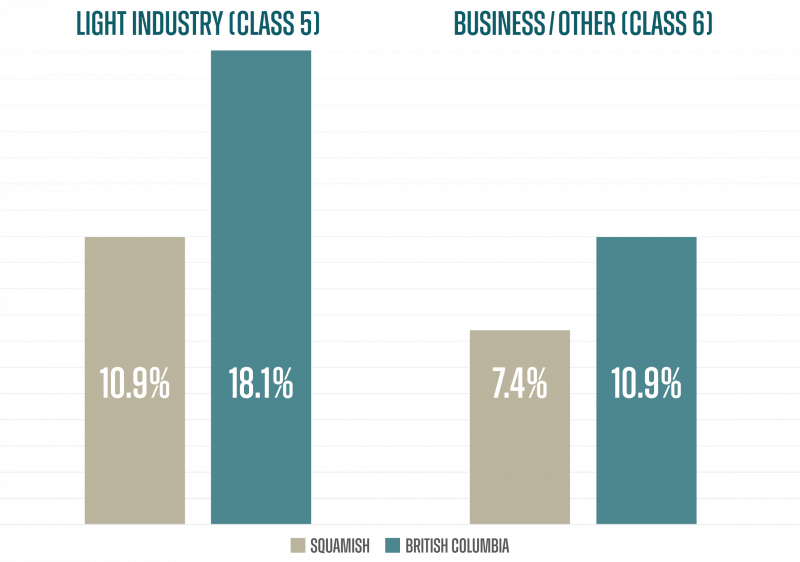

Squamish tax rates are competitive relative to rest of BC. Squamish's light industry (Class 5) tax rate in 2021 was 10.9% compared to the BC average of 18.1%. In 2021, Squamish's business (Class 6) tax rate was 7.4% compared to an average of 10.9% in BC.

For more detail on Squamish's tax rates visit squamish.ca.

Did you know that British Columbia boasts some of the cleanest and most affordable energy rates in the world? Nearly 98% of the electricity generated in BC comes from clean or renewable resources contributing to electricity rates in British Columbia being among the lowest in North America. Get information on utility rates at the links below.

Utility providers

Favourable business climates in BC and Canada

Accessible tax credits, incentives, and exemptions can help you and your employees keep more of what you earn, personally, and corporately. Tax credits for training, scientific research and experimental development, property tax exemptions, and investment capital allowances are potential opportunities to encourage business investment, innovation, and growth in BC.

Learn more by visiting the Trade and Invest BC and Invest in Canada websites or by checking our investment resources.